Some traders also refer to tick volume as on balance volume. The volume we see on our charts is not the true actual volume its the tick.

The Use Of Tick Volume Paige

The Use Of Tick Volume Paige

Volume is calculated based on price ticks.

Forex what is tick volume. Proper use of the volume correlation mechanism allows to catch the moment of large smart money entering the market. In todays article i want to spend a little bit of time explaining how we can use volume to get a better understanding of whats going on in the market. 1 tick is 1 vol! ume.

But also the correlation between tick volume and actual volume traded is incredibly high. Tick volume is measuring every trade whether up or down and the volume that accompanies those trades for a given time period. High volume will have lots of such simple tick shifts while low volume very little.

For the pairs he studied he calculated the correlation between tick volume and actual volume is over 90. He used data from esignal ebs and hotspot. How you should really use volume in the forex market.

At first glance it seems to be a good approximation of real volume but in reality it is a poor substitute which can only serve as a simulated measure of something. Once youve been trading for a while you might have come across forex tick charts. Many traders dismiss volume as not being reliable and to some extent this belief is true.

In this article we will see whether tick volumes can be r! eliably used in forex. In 2011 caspar marney head of marney ca! pital and ex ubs and hsbc trader conducted an analysis of actual volume and tick volume in forex. The proposed precise strategy of tick volume analysis is another alternative to short term trading and the opportunity to earn with the market makers.

Tick volumes in forex have sparked much debate among trading communities on what information they provide and how they compare to regular volumes. Many forex traders assume there is no volume in the foreign exchange market. The tick charts are usually accompanied by some explanation on why theyre so much better than traditional candlestick charts.

If you are a day trader or a short term swing trader tick volume analysis will assist you in sizing up the market on an intraday basis. As price changes back and forth volume adds up. And they would be correct.

Tick volume that is present in every metatrader platform is based on the number of price updates ticks that come! during the formation of a given bar. Volume indeed cannot be calculated based on the number of contracts traded and the size of those contracts since forex market is decentralized by its nature. There is no central exchange not yet anyway.

Using Volume Trading To Improve Your Results Analytical Trader

Using Volume Trading To Improve Your Results Analytical Trader

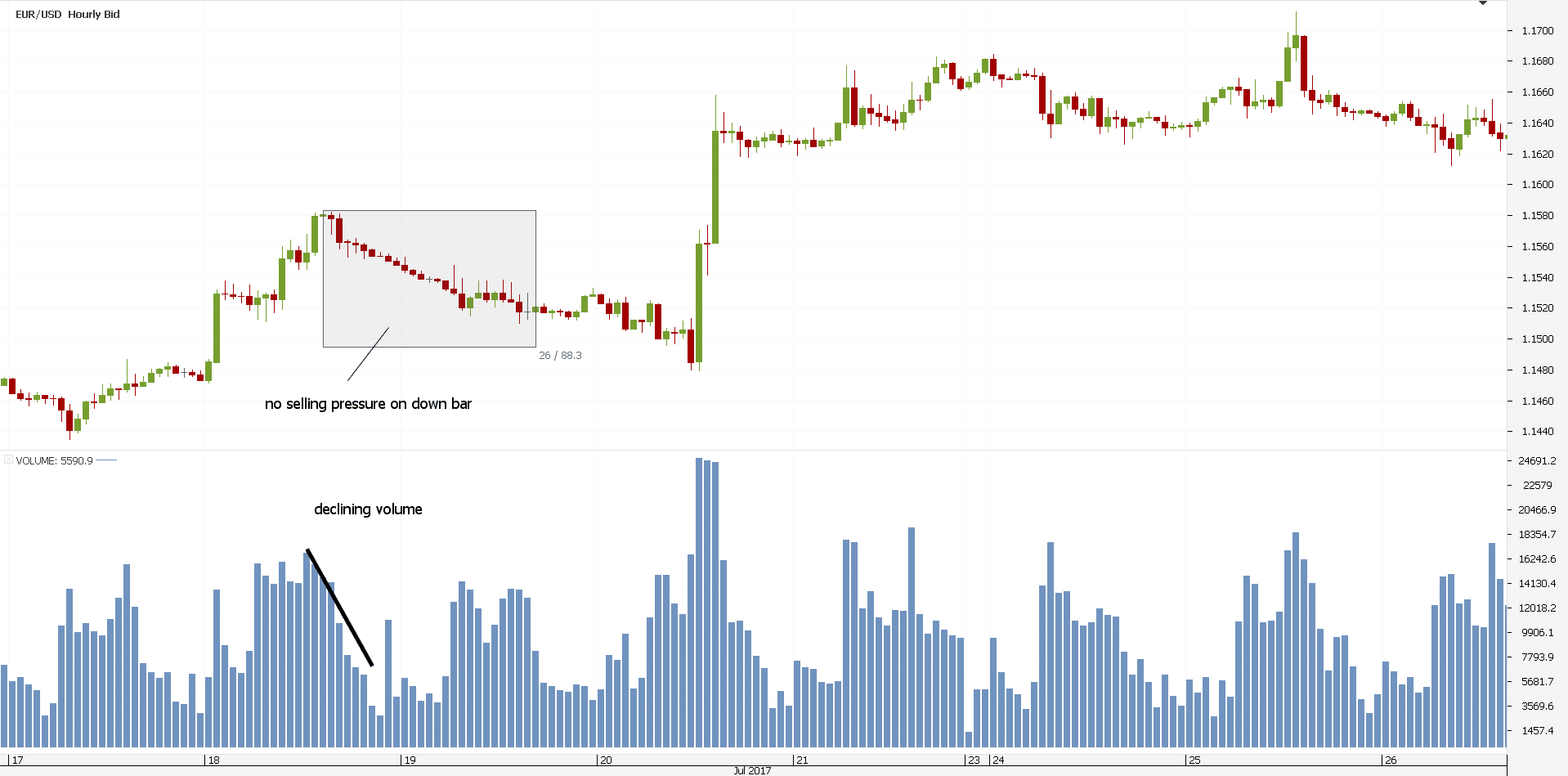

Eur Usd Lesson On Reading Tick Volume Types Of Acceleration ! For

Eur Usd Lesson On Reading Tick Volume Types Of Acceleration ! For

Using Volume To Help With Trend Trading

The Better Volume Indicator Free Code Emini Watch Com

The Better Volume Indicator Free Code Emini Watch Com

Trading Volume In Forex For Beginners Trading Strategy Guides

Trading Volume In Forex For Beginners Trading Strategy Guides

Why Is Tick Volume Important To Monitor In The Forex Market

Tick Volume Indicator Mq4

Top Rated Volume Trading Strategies How To Trade On Volume

Top Rated Volume Trading Strategies How To Trade On Volume

Identify Reversals In Forex Tick Volume Indicator For Metatrader Mt4 With Email Alerts

Identify Reversals In Forex Tick Volume Indicator For Metatrader Mt4 With Email Alerts

Forex Volume Indicator Mt4 Trading Strategies Forexboat

Forex Volume Indicator Mt4 Trading Strategies Forexboat

Metatrader 4 Tick Volume In Fx Does Not Equal Liquidity Fxgears

Tick Volume Forex Devisenwechsel In Delhi Ncr

Tick Volume Forex Devisenwechsel In Delhi Ncr

Forex Volume Indicator Effective Control Of Volumes For Stable Profit

Forex Volume Indicator Effective Control Of Volumes For Stable Profit

Ticks Volume Indicator Free Mt4 Indicato! rs Mq4 Ex4 Best

Ticks Volume Indicator Free Mt4 Indicato! rs Mq4 Ex4 Best

Always In The Trend Or A Precise Strategy On Tick Volume